BlockTradeX: Blockchain-Powered Digital Trade Finance for SME Exporters

Business Overview

Overview

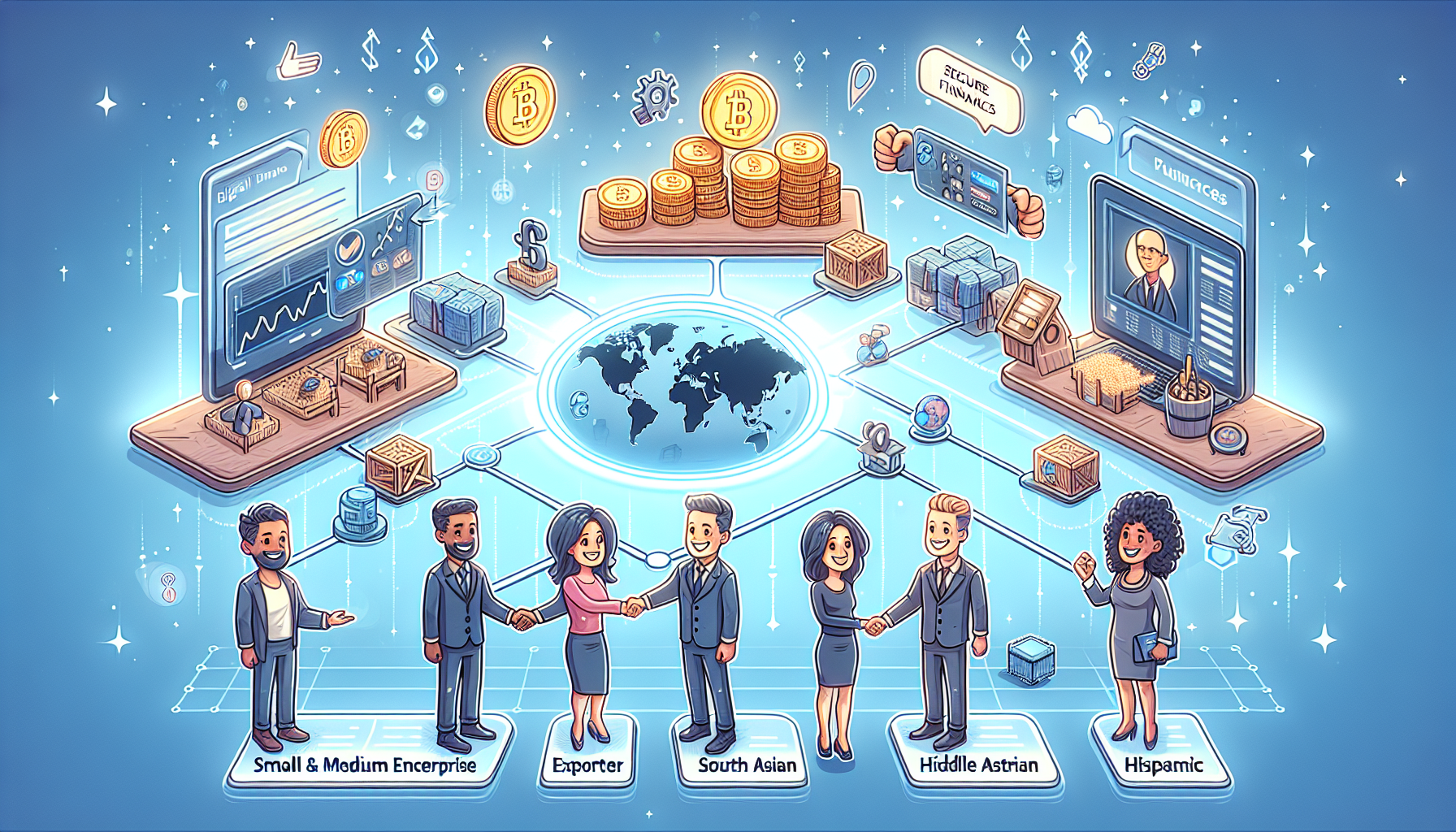

BlockTradeX is an innovative digital platform designed for SME exporters to access trade finance quickly and securely by leveraging blockchain technology. The platform digitizes and automates the entire trade finance process—document verification, contract execution, and payment flows—eliminating costly intermediaries and reducing fraud risk. It enables small and medium-sized businesses to grow their international trade with less friction and improved liquidity.

Key Features

The platform includes several critical features tailored to SME needs:

- • End-to-end digital onboarding and KYC/AML verification using decentralized identity solutions

- • Smart contracts that automate Letters of Credit and payment triggers

- • Real-time document tracking, audit trails, and secure file sharing for compliance

- • A marketplace connecting exporters, financiers, and insurers for efficient deal-making.

User Experience

BlockTradeX offers a streamlined, SaaS-driven interface for SMEs to onboard, submit documents, track applications, and receive financing offers—all in a few clicks. Powerful API integrations allow seamless data exchange with ERPs, logistics providers, and banks for one-stop management, while automated notifications keep all stakeholders in the loop.

Market Opportunity

Over 40% of SME trade finance applications are currently rejected worldwide, largely due to manual processes, lack of transparency, and high operational costs. There is a $1.7 trillion global trade finance gap for SMEs. Adoption of digital and blockchain-based solutions is rapidly increasing among financial institutions, and SMEs urgently require accessible tools to remain competitive in global markets.

Industry Trends

The global trade finance market is rapidly evolving, with digital transformation and blockchain adoption accelerating processes and reducing costs. Fintech investment in this space has grown over 35% in the past two years, reflecting increasing confidence in digital-first solutions.

Target Market

BlockTradeX primarily targets SME exporters in emerging and developed economies, B2B importers/exporters, and financiers like alternative lenders and banks interested in expanding SME portfolios.

Competitive Advantage

Few platforms currently combine a blockchain foundation, smart contract automation, and an integrated marketplace. By offering transparent, secure, and cost-efficient cross-border finance, BlockTradeX positions itself as a trusted solution in an underserved segment.

Ready to Start Your BlockTradeX: Blockchain-Powered Digital Trade Finance for SME Exporters Business?

Get a comprehensive business plan with financial projections, marketing strategies, and step-by-step guidance.